Transferring large sums of cash physically is a very dangerous task. Unscrupulous individuals may attempt to steal your cash from you, especially if they already know how much you are carrying and have information on where you are heading. There are two ways to protect yourself when moving large amounts of cash; the first is to hire a security service such as an armored van, the next is to wire transfer the sum. Out of the two, the second option is the most practical and safe.

What is a Wire Transfer?

A wire transfer is a process of transferring money electronically between two parties. No physical cash is being moved during a wire transfer. Instead, owners of the money will instruct their banks to transfer a specified amount of money to the receiver’s account regardless of whether the receiver’s account is under the same bank. Please take note, however, that banks charge you fees when completing a wire transfer with them.

When Should You Use a Wire Transfer?

A wire transfer is an efficient tool in moving money domestically or internationally within the same day. However, international wire transfers may take up to three banking days, depending on foreign countries’ banking regulations. A wire transfer is also useful in moving large sums of money; however, different financial institutions or banks may have a cap on the maximum amount you can transfer.

How Do You Complete a Wire Transfer?

To complete a wire transfer, you will need to have two important information, namely the routing number and the account number. You must have this information about your account and the account of your intended receiver.

Account Numbers. Banks assign account numbers to each account holder. Account numbers are unique for each bank. Most banks will assign account numbers that have eight to twelve digits.

Routing Numbers and SWIFT Codes. A routing number is a series of nine digits used to identify specific banks or financial institutions within the United States. A routing number will let the system know that the bank maintains a Federal Reserve account. A routing number will inform the wire transfer facility what bank you have an account with. Routing numbers are used for domestic wire transfers only. On the other hand, if you need to transfer funds from a U.S. bank to a foreign bank, you will need to enter the foreign bank’s SWIFT Code number in place of the routing number.

Wells Fargo Wire Transfer Rates

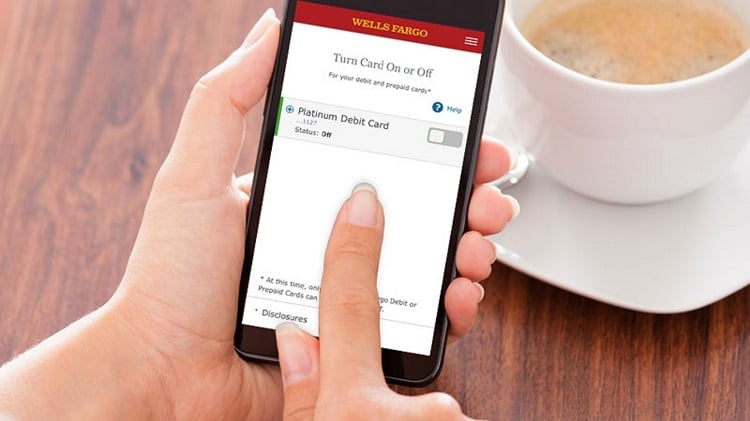

If you need to transfer money from your account to an account under Wells Fargo, you will need to know the routing number of Wells Fargo and your intended recipient’s account number. The routing number of Wells Fargo for domestic wire transfers is 121000248.

On the other hand, if you are going to receive money from overseas and want it wired to your Wells Fargo account, you need to give the sender the SWIFT Code for Wells Fargo, which is WFBIUS65.

Remember, your wire transfer will not push through unless you entered the correct routing number and bank account number. However, you should not worry if you entered one of these numbers incorrectly. Banks will reject the wire transfer if the pieces of information do not match. Banks will cancel the wire transfer and return the money to you.