Taxes are part of the backbone of modern civilization. They are what allow our governments to keep the society functioning such as medical care, infrastructure, responding to emergencies, and more. Even though everyone understands the importance of taxes, practically no one likes paying their tax bill. But everyone has to anyway. Even though you can’t get out of meeting your financial obligation towards the state and federal government, there are ways you can reduce the financial burden.

How To Reduce Your 2021 Tax Bill

There are several ways to reduce your tax bill legally, and most of them are valid every year, though your personal circumstances and yearly income might dictate how much you might be able to save on your taxes.

1. Be Generous with Your 401(k) Contributions

A traditional 401(k) comes with the added benefit of reducing your taxable income since you contribute to it with your pre-tax income. It’s always a good idea to max out your contributions, at least till the level your employer is matching your contributions dollar for dollar (or at a different ratio). This way, you will also reduce your taxable income and might field a lighter bill.

2. Feed Your Retirement Savings Account

If you have a Roth IRA, you will get your tax break in retirement when you finally start drawing money from your retirement accounts. But traditional IRAs are great for offsetting your tax bill this year if your income is below the threshold ($125,000 for 2021) and you are not covered by an employer-funded retirement plan.

3. Claim Home Office Deductions on Your Tax Bill

If you’ve worked from home for a significant amount of time, you can claim home office deductions. After 2020, many people are planning to switch to remote work full or most of the time, and this nifty deduction can be their friend for every tax season.

4. Consider Earned Income Tax Credit

For people with low incomes, Earned Income Tax Credit (EITC) is also worth looking into. If you qualify, you might be able to reduce your tax bill. Meaning, the actual tax amount you are liable to pay (which is different from a tax deduction, where you lower your tax amount by reducing your taxable income), by about $7,000.

5. Medical Expenses and Your Tax Bill

Your medical expenses are another area you can save some of your dollars from flowing into Uncle Sam’s pocket. If you rake up a high enough medical bill through deductibles and other out-of-pocket expenses (that can happen even if you do have a decent medical plan), you might be able to claim a tax deduction. The threshold is medical expenses (collectively) higher than 7.5% of your adjusted gross income.

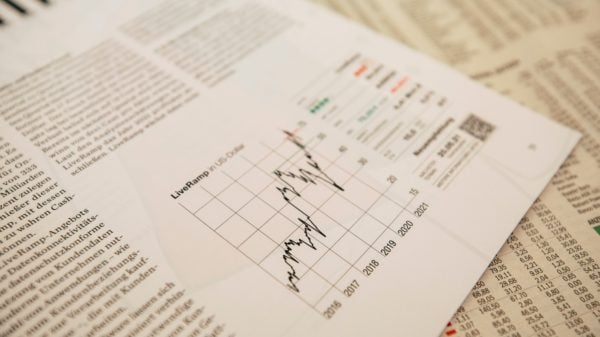

6. Offset Investment Taxes

The taxation of investment assets aims to strike a balance, i.e., losses can neutralize the taxes you might owe on your investment profits whether these investments are in stocks or other assets (real estate is ideal in this regard). So if you have a high tax bill thanks to the capital gains, you might be able to offset some of them by getting rid of the losers. But don’t sell a stock just to offset capital gains.

Conclusion

There are several other ways you can reduce your tax bill as well; some of them might be specific to your situation. Understanding the deductions and tax credits you are eligible for is necessary financial wisdom that every individual should seek.