One of the most challenging tasks to do as an adult is to save money. Even when you’re still in college, setting aside a portion of your monthly allowance can be difficult. But the hard truth is, everyone should learn how to be responsible for their finances. Otherwise, there’s no use in working so hard and having a lucrative career only to end up bankrupt later on. If you belong to this group, reading the rest of the article may enlighten and convince you to begin saving up now.

Set a budget

As soon as you have a rough estimate of how much your monthly expenses are, start to evaluate your expense records and determine a feasible budget. This amount must cover the cost you’ve specified and would fit right in your income. This way, you don’t overspend and know how much money is left after all the expenses. Don’t forget to include the costs you have to settle regularly but not on a monthly basis like vehicle maintenance and the like. According to financial experts, try to set aside about 10% of your income as your savings.

Identify your savings objectives

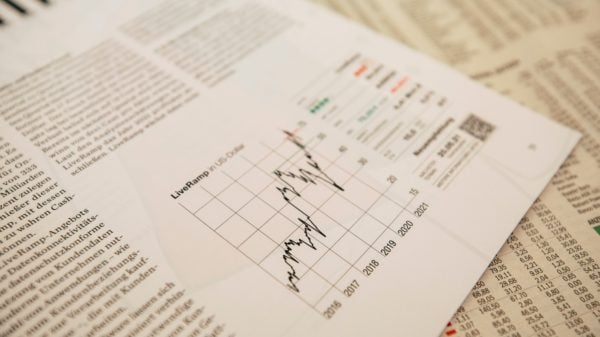

One of the ideal methods to save cash is to set an objective. Begin by evaluating the things you wish to save up for, such as traveling to another country, buying a house, getting married, or your retirement. Then, identify the respective amounts needed for each and a feasible time frame for saving for those pursuits.

Some people use financial management plans for their children’s education and their retirement. In contrast, others put their funds on investments, which allow their money to grow. Categorize your goals, which one is for short-term or long-term. From there, work on achieving one at a time and prioritize, so you don’t run out of money. There’s no point in saving for those goals if you can’t finance your regular expenses.

Make a budget

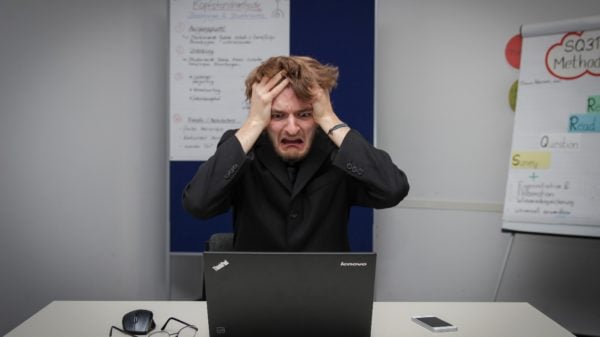

Keep track of your expenses

As part of the saving process, recording every money that comes out must be recorded. This will allow you to gauge how much you spend on things like coffee, groceries, petrol, and tips. Everything has to be accounted for.

After gathering all the necessary information, group them like for utilities, communications, entertainment, or groceries. Get the total for each of the categories and assess if some of them are too high. It allows you to adjust your spending on unnecessary costs.

To keep the recording process easier, some individuals use a cash management track and install it on their phone. This will effectively help you track even up to the last dollar of the expenses you’ve made.

Improvise your spending habits

When you notice that you’re spending too much on food or shopping, try to adjust and assess the things you buy. Ask yourself if they are essential? Are there other cheaper options? Things like these will enable you to improvise your spending attitude. If you think you go out too much on weekends, try to limit it or stay home and ask your friends to come over instead. This is a much cheaper alternative than driving to a restaurant, consuming petrol, and paying for insanely expensive dishes. When you stay at home, no food and transportation expenses are involved.