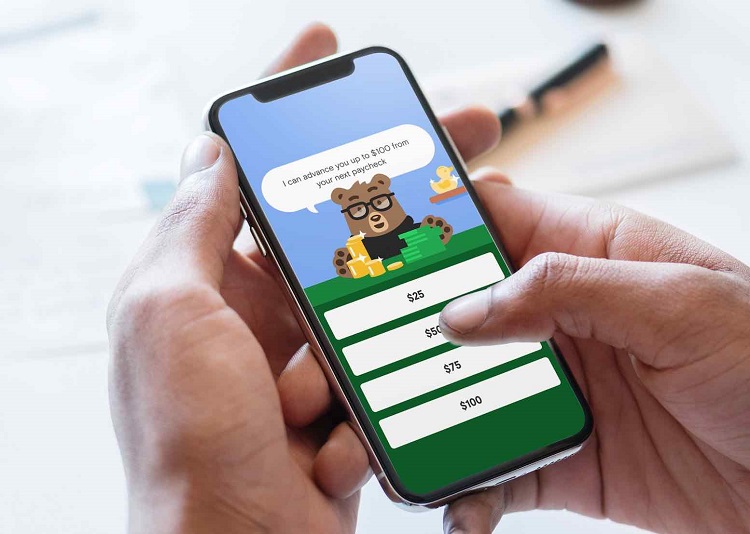

Most use Dave because of how it has saved many, permitting them to cover their approaching expenses until they get their next paycheck. Another great thing about Dave is that you do not have to fret about crazy interest rates. Anyone can pay off the $1 fee with ease, and you can even waive the fee by purchasing from individual businesses.

However, you should realize some drawbacks when using Dave. One of those is you can only have a maximum of $100 in payday advance. Fortunately, you can find other alternatives that may have other benefits that Dave does not have. You can even combine the cash apps if you want total command over your finances.

1. Even

The first app on the list is Even, one of the leading financial planning apps that can provide cash advances as much as 50% of your earned money. The only downside is that you need to work for a qualifying employer to compare financial plans available on the app. If you plan on withdrawing cash the same day, you can visit the nearest US Walmart. It is also a more expensive app than Dave since you need $8 for a monthly “Even Plus” membership.

You can check your bank account thrice a day, unlike Dave. It will also notify you with an “okay to spend” amount for your expenses, and it can allocate a precise amount from your bank account to avoid facing financial troubles throughout the month’s end.

2. Brigit

It provides a better cash advance of up to $250 than Dave. The app also has an automatic withdrawal option if you start seeing that your bank balance is short. It analyzes your account rigorously and predicts your spending habits to avoid overdrafts. Also, it gives you the chance to extend your payment due date if you fail to repay it on time.

Like with any other cash advance apps, Brigit also has its disadvantages. One is that Brigit is the most expensive cash advance app that is out there. It will set you back $120 annually, compared to Dave, which only costs $12 yearly. Another downside is the funding speed is slower than Dave, and you have to match a long list of eligibility basis. Furthermore, the app requires you to make more than $1,500 per month to qualify.

3. Branch

Branch is more than just a cash advance app because it allows you to chat with your coworkers, manage your work life, and even track your working hours. Besides that, you can get $500 per pay period in $150 increments each day, depending on how many hours you have worked. You can find that Branch is similar to Dave and does not charge anyone for membership.

The only thing you have to make sure of is to keep a steady paycheck if you want to use cash apps efficiently.