Financial intelligence is a big deal right now- no one wants to end up on the bad side of the economy after all. But is all the fuss worth it or do personal finance classes simply regurgitate a lot of information that you would be better off not paying for?

Here are five reasons why you actually stand to gain by taking a personal finances course:

Lower Risk of Bad Credit and Huge Debts

Studies have shown that people who took personal finance courses in their early years grow up with a lower risk of having bad debts and credit which helps improve their overall quality of life.

These effects are passed on to their offspring since they are more likely to impart any children that they might have with the skills and information they got as well as encouraging them to take similar courses in school.

unsplash.com/@micheile

It Gets Easier to Manage Your Income

Financial literacy will make income management a breeze as you will know what expenses need to paid up immediately, which ones can wait, and which ones to do away with.

There will be less stress overall when you can easily figure out how much to put aside for taxes and such and come up with an almost accurate approximation of what you will be able to save when all is done.

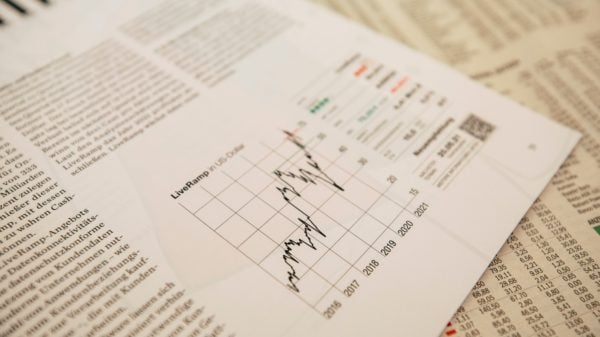

You can Better Grow Your Assets

When you own assets whose real values you know well, you are cushioned from financial emergencies to a large extent. When you can effectively grow these assets, you increase your likelihood of a stress-free retirement and avoiding getting trapped in employment when you didn’t plan on it.

Finance classes can help you come up with plans for methodically decreasing your debt and leaving some for a rainy day as well as enable you to get rid of those assets that may turn into liabilities down the road.

You Meet Your Money Needs Easily

Personal finance knowledge gives you the ability to come up with a solid plan of what to do with money once you get it. This way, you don’t end up in a vicious cycle of spending faster than you earn.

Life becomes easier when you can come up with budgets, pay bills well, manage loans effectively, and start a savings journey that doesn’t feel like a chore.

You Get a Better Quality of Life

With personal finance training, you will be great at catching habits and expenditures that cost more that they’re worth. In the long term, you will be able to save more which will enable you to live better with less debt and the ability to get important or worthwhile things that you need, like a great vacation to help you unwind!

The Takeaway

It’s easy to see why financial literacy is all the rage right now and personal finance classes will help you develop it. Every generation has witnessed at least one economical collapse and it’s not something to smile about.

If you can keep yourself from going bankrupt at some point of your life, it’s in your best interests to do so. You will thank yourself when you’re living debt-free and can even splurge on yourself- or a loved one- when the occasion calls for it.