The U.S. Could Go Into Recession if Economy’s “Safety Net” Disappears

As the American economy is experiencing a major downturn, some worry that the country’s economic “safety net” could soon disappear.

Even during difficult moments such as the pandemic, consumer spending was the one constant that the American people could count on to keep the economy afloat. However, a recent survey revealed that consumer spending is likely to lessen, which would create quite a predicament for the state of an already sinking economy. The results of reduced consumer spending could result in the US spiraling into a recession.

Personal Spending Has Helped the Economy

Entertainment has been a leading stream of revenue for the US economy, especially in 2023. Blockbuster films such as Barbie and Taylor Swift’s nationwide “Eras” tours have been big money makers this year, and the economy is reaping the benefits.

Source: Scott Legato/TAS23/Getty Images

Barbie has seen record-high earnings, taking in a massive $609.5 million at the US box office and over $1.4 billion globally. But that’s nothing compared to how much Taylor Swift has contributed to the economy with concert ticket sales. Swift’s immensely popular Eras tour is expected to generate close to $5 billion in the United States alone. “If Taylor Swift were an economy, she’d be bigger than 50 countries,” said Dan Fleetwood, President of QuestionPro Research and Insights.

A Reality Check Could Put an End to Frivolous Spending, Meaning More Bad News for the Economy

Aside from the movies and stadium tours, the US will need to be more resourceful to keep the economy from plummeting. Even though interest rates soared over the past 18 months, consumers still emptied their wallets to buy tickets to the hottest shows in town.

Source: Alfred Gescheidt/Getty Images

Now, excited concert-goers have a harsh fall back to reality after realizing that the delayed impact of higher interest rates, student loan payments restarting, and pandemic savings coming to an end will have a significant effect on their bank accounts.

Personal Consumption Expected to Take a Nosedive

Many believe that the fun is coming to a close for American consumers, who are likely to start saving instead of spending in the coming months.

Source: Wikimedia Commons

According to a recent Bloomberg Markets Live Pulse survey, 21% of over 500 investors believe that ‘personal consumption’ will decrease as we approach the end of the year. Interestingly, 56% believe that consumption will reverse by the turn of the new year. The economy’s “safety net,” i.e., American retail consumerism, could be in a compromising position.

Higher Interest Rates Continue to Be a Problem

The Federal Reserve Bank of New York released a statistic stating that Americans had reached record high amounts of credit card debt this year, tipping the scales at more than $1 trillion.

Source: Victor Manley/Getty Images

The Federal Reserve began increasing the cost of interest rates from 0.25% to 0.50% in March 2022. The change was an attempt to combat inflation, and many people, such as homeowners, already had low interest rates set. America as a whole has been piling up credit card debt, and as interest rates continue to climb, that debt has taken a toll on American consumers.

Is There a Recession on the Horizon?

Economist David Rosenberg has offered his two cents on America’s economic issues, saying that it would usually take six months for a recession to hit the economy after a substantial uptick in interest rates.

Source: Wikimedia Commons

Rosenburg believes the country should brace for the real possibility of a recession, saying, “I think that by the third or fourth quarter, we’re going to start to see more evidence, but it’s going to come [from] the consumer side, not the corporate side.”

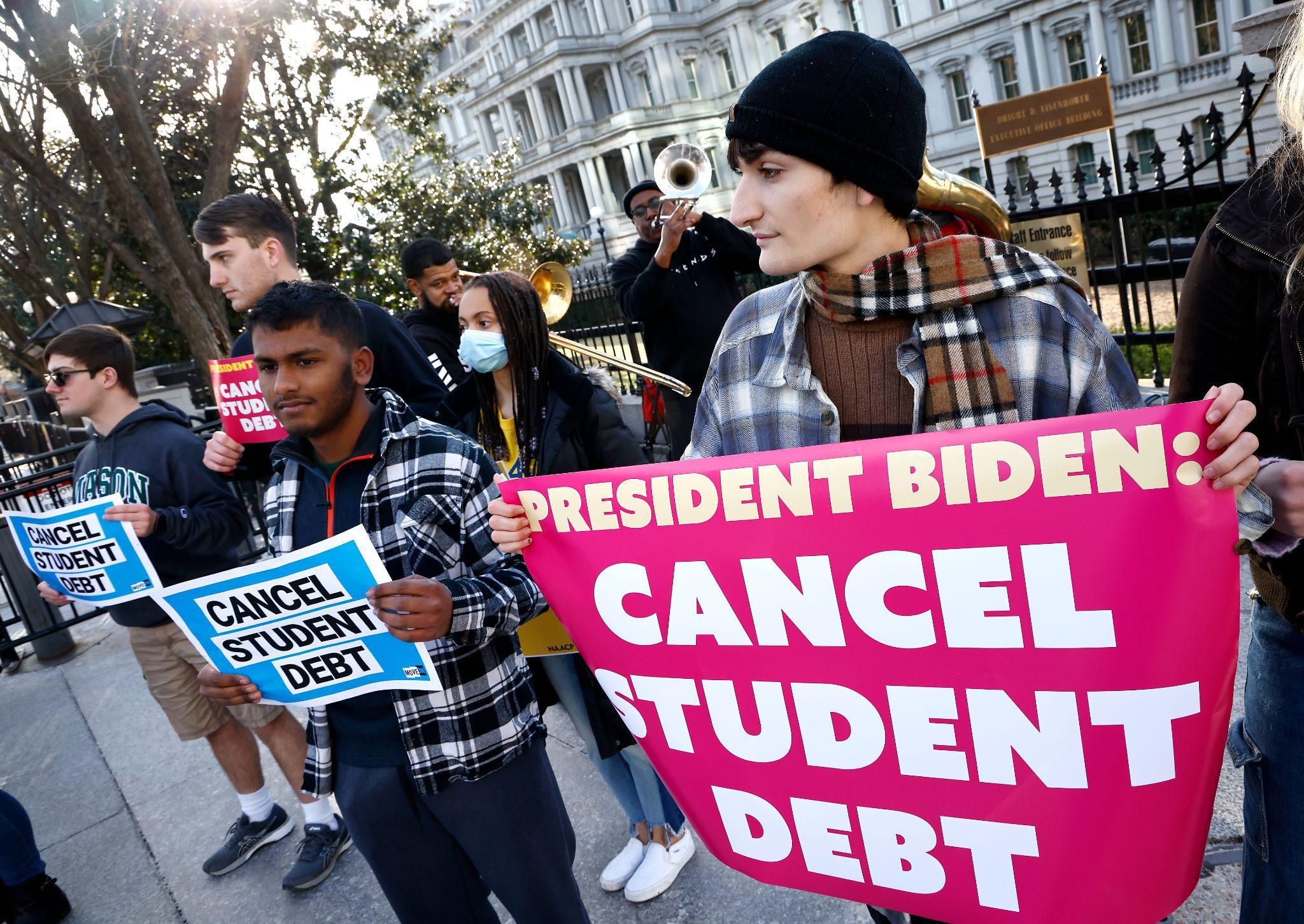

The Drama Surrounding Student Debt

After President Biden recklessly vowed to forgive more than $430 billion in student loan debt and was turned down by the Supreme Court, millions of Americans will likely struggle to pay their mounting education bills.

Source: Paul Morigi/Getty Images

Student loan payments were temporarily put on pause at the height of the pandemic, as the nation was on lockdown and many people were unable to work and produce a viable income. Now that the coronavirus pandemic is over, student loan payments are set to make a comeback in October, creating immense financial stress for borrowers. Unsurprisingly, more than 34% of borrowers have said they’ll be unable to make the required payments.

Bank Accounts Have Been Emptied Out

Finance experts have always recommended saving 20% of your monthly paycheck. While many Americans were able to take advantage of the pandemic by safely putting away their earnings in a “rainy day” fund, others had difficulty surviving on what little they had.

Source: Robert Alexander/Getty Images

Personal savings in the United States have fallen hard after the pandemic. Any money that the American people saved during the lockdown has already been depleted, leaving little to fall back on in the event of an emergency. The stockpile of cash was what helped keep the economy from crashing, but high interest rates and even higher inflation have resulted in bank accounts being wiped out across the country.

Time To Start Pinching Pennies

The US has shown some signs of an improving economy. A strong job market is a solid indicator of an economy starting to turn things around.

Source: Wikipedia

Treasury Secretary Janet Yellen believes it’s possible for the country to reduce inflation while avoiding a recession. “I am feeling very good about that prediction,” she said. But not everyone is as convinced. Macy’s recently revealed that it’s been making fewer sales due to the “financial pressure” shoppers are under.

Shopping Is About to Change for American Consumers

On the flip side, retailers such as Walmart have benefitted from consumers spending money on essential items. John David Rainey, CFO of Walmart, revealed, “Customers are stretching their dollars further and seeking better value across more categories, more often.”

Source: Matt Cardy/Getty Images

Jamie Dimon of JPMorgan insists that America’s economy is facing huge risks. “I just think people make a mistake to look at real-time numbers and not look at the future. And the future has quantitative tightening,” he said.

Excess Spending Is Happening All Over the World

Dimon also mentioned how there has been a global spending spree across the board, saying, “We’ve been spending money like drunken sailors around the world. To say the consumer is strong today means you have to have a booming environment for years is a huge mistake.”

Source: Matt Cardy/Getty Images

Nancy Lazar, chief global economist at Piper Sandler, believes that the economy is “overheating” and that things are about to get more “painful” for the American people. “Save your pennies because, unfortunately, the economic outlook is going to get worse before it gets better,” she said.

Will America’s ‘Safety Net’ Go Away?

As the state of America’s economy remains up in the air, Lazar warned that now is the time to “hunker down and to try to maintain your savings rather than get further into debt.”

Source: Alex Wong/Getty Images

Inflation, higher interest rates, and student loans have been pummeling the American people for years, and it remains unclear whether or not things will improve any time soon. With personal consumption expected to pull back, the economy could suffer even more than it has in decades.