Deutsche Bank Reduces Trump’s Self-Reported Net Worth Based On A ‘Haircut’

The mention of the Trump “haircut” occurred during Trump’s ongoing New York civil fraud trial, now in its second week. The term surfaced during a nuanced financial discussion.

Evaluating Trump's Worth

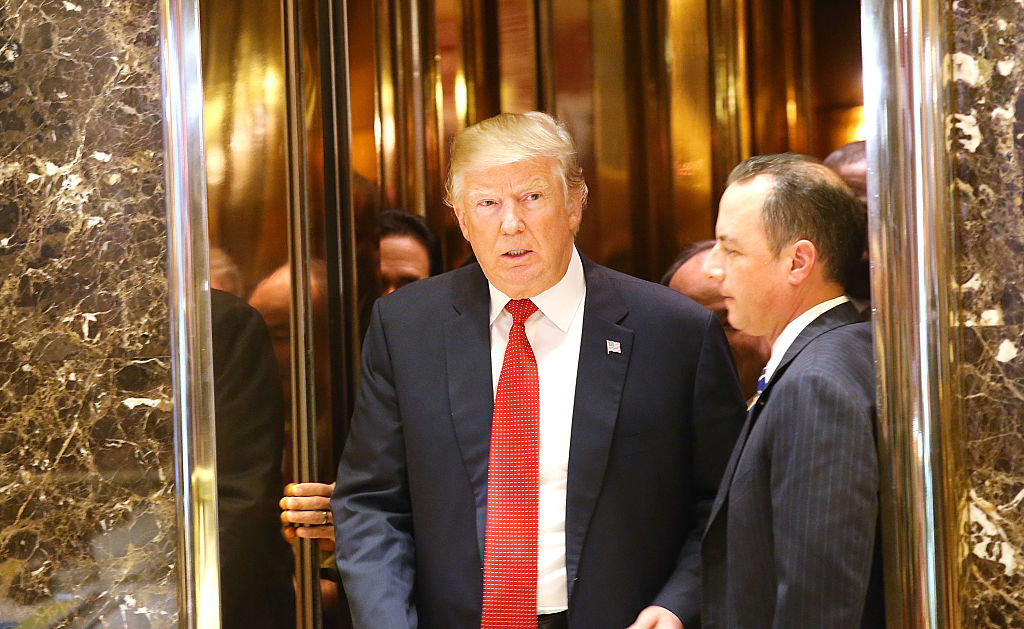

This is how Deutsche Bank, Donald Trump’s most generous lender, described the routine adjustments they applied to the valuation of whatever amount the former president claimed to be worth.

Source: Sean Gallup/Getty Images

What's A Haircut?

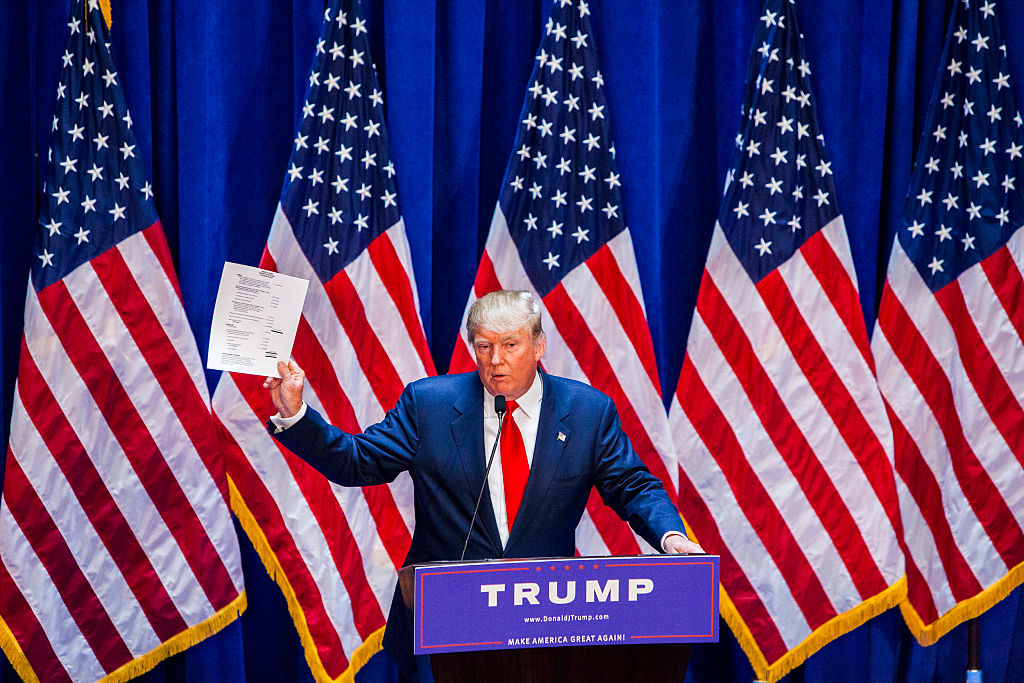

“First of all, what is a haircut?” Kevin Wallace, an attorney representing the Attorney General’s office, inquired while examining one of the former president’s key financial associates, Nicholas Haigh, often regarded as a banker in Trump’s financial dealings.

Source: David Dee Delgado/Getty Images

Understanding An Asset's Stated Value

Haigh played a pivotal role in approving the more than $400 million in loans that Deutsche Bank extended to the former president over the past decade.

Haigh explained in his British accent that “A haircut is a way by which the bank reduces the stated value of the asset in order to form some kind of assessment of what it might be worth.”

Source: Thomas Lohnes/Getty Images

Trump's Fluctuating Net Worth

The banker demonstrated that Trump’s net worth fluctuated significantly before and after the haircut.

Source: Mike Pont/WireImage

Trump's 'Credit Report'

In 2011, Trump informed the bank that he was worth $4.26 billion. However, following the bank’s haircut, which was considered a potential default, his value could plummet to as low as $2.365 billion, as indicated on the fourth page of Deutsche Bank’s 2011 Trump “credit report,” an internal banking document submitted as evidence during the morning proceedings.

Source: Isaac Brekken/Getty Images

Worst-Case Scenario

The “Trump haircut” was Deutsche Bank’s method of taking Trump’s optimistic self-evaluations of his wealth and utilizing them to assess his value under a worst-case scenario.

For instance, if he defaults on a loan, the bank would determine the potential worth of his properties, such as golf courses, in a depressed market.

Source: Spencer Platt/Getty Images

Self-Reported Net Worth

This term was first introduced nearly two years ago in a court filing by the attorney general’s office, outlining how the bank employed Trump’s self-reported net worth to calculate their own separate, more conservative “stress scenario” valuation.

Source: Michele Eve Sandberg/Corbis via Getty Images

Assessing The Internal Documents

Within the lender’s internal documents were Trump’s self-declared figures in his annual Statements of Financial Condition.

Adjacent to these figures, in a distinct column, was his “DB adjusted” value, which represented Deutsche Bank’s fire-sale price calculated by applying a percentage “haircut.”

Source: Christopher Gregory/Getty Images

The Bank's Loans Helped Build Trump's Empire

The determination of Trump’s value after the “haircut” played a pivotal role over the years in assessing “whether to extend or maintain credit,” as stated in the Attorney General’s filing.

This calculation significantly influenced the bank’s decisions regarding lending money to Trump and permitting him to retain that money throughout the loan’s duration.

These loans played a substantial role in the development of the Trump empire and the creation of the reputation that ultimately propelled him, as a billionaire businessman, into the White House.

Source: Aaron P. Bernstein/Getty Images

Applying The Haircuts

Deutsche Bank provided financing for Trump’s ventures, including the Trump National Doral Miami golf resort (a loan of $125 million), the Trump International Hotel & Tower in Chicago (a loan of $107 million), and the renovation of the Old Post Office in Washington, DC (a loan of $170 million).

Deutsche Bank applied varying “haircuts” depending on the type of asset. For instance, the “haircut” on cash was relatively small since cash typically doesn’t depreciate, as Haigh testified on Wednesday.

Source: Scott Olson/Getty Images

Trump's Asset Properties

However, when it came to Trump’s golf resorts, the “haircut” was a significant 50%, as he attested.

In 2011, Deutsche Bank applied a substantial 75% “haircut” to Trump’s reported valuation of his Seven Springs estate in upstate New York.

This reduction was due to the valuation encompassing the development of nine luxury “mansions” that were yet to be constructed.

Haigh clarified, “Asset properties that are not yet developed have a larger range of possible impacts on their value” in the future.

Source: Robert Perry/Getty Images

A Point Of Contention

Deutsche Bank’s decision in this regard ultimately proved to be prescient. The Attorney General contends that the nine planned mansions were essentially fictitious, as zoning laws and other local regulations had already barred their construction, despite Eric Trump’s earlier efforts.

This remains a point of contention in the trial.

From Trump’s perspective, it’s highlighted that he never defaulted on his loans, and Deutsche Bank earned substantial sums through interest on those loans.

His legal team asserts that the bank willingly lent him money, even in light of their most severe “haircut” calculations, and was not victimized in any way.

Source: Chip Somodevilla/Getty Images

Conspiring To Inflate Trump's Net Worth

The Attorney General countered this argument, emphasizing that when lending to Trump, Deutsche Bank considered his adjusted, worst-case “haircut” value and his self-reported worth.

Expert witnesses from the state are expected to testify that it is improbable that the bank would have extended loans to Trump had they known these figures were inaccurate.

Attorney General James has accused the defendants in her lawsuit—Trump, his two eldest sons, and two former longstanding executives—of conspiring to inflate his worth by as much as $3.6 billion annually in a decade’s worth of the annual financial statements used to secure and maintain his loans.

Source: Julie Bennett/Getty Images

A 'Minor' Error

Among her sought penalties, James aims to permanently prohibit him from conducting business in New York. She has already secured a pre-trial ruling that could transfer control of the Trump Organization to a receiver tasked with liquidating assets.

Haigh’s testimony was provided during a break in the extended testimony of Allen Weisselberg, Trump’s former CFO, who had stated on Tuesday that Trump’s tripling of the square footage of his penthouse in financial statements over five years constituted a “minor” error.

Source: Brendan McDermid-Pool/Getty Images