Biden’s Economy Causes Mass Exodus From New York and California

A consistent trend continues as Americans persist in relocating from states like New York and California, primarily motivated by more attractive home prices and tax incentives.

However, industry experts raise substantial concerns about the lingering economic consequences of these migrations, set against the backdrop of the Biden administration’s policies.

Pandemic-Induced Migration: A New Way of Life

The COVID-19 pandemic proved to be a catalyst for a significant shift in how people perceive their living arrangements. As remote work became a viable option for many employees, they discovered the freedom to move away from the high-cost urban environments they once inhabited.

Source: Michael Discenza/Unsplash

Steven Pesavento, founder of Finch Capital, points out that this shift presented individuals with an opportunity to escape the financial strain of urban living and the burden of restrictive policies.

California's Population Decline

California, for the first time in recent memory, witnessed a decline in its population in 2020. This decline continued into 2022, with over half a million residents departing the state.

Source: Pedro Marroquin/Unsplash

The sheer magnitude of those leaving far exceeded the number of newcomers, resulting in a significant net loss for California.

Tax Revenue Losses in California

Intriguing insights from IRS migration data, analyzed by MyEListing.com, reveal that California experienced a substantial erosion of tax revenue.

Source: Henning Witzel/Unsplash

The state suffered a loss exceeding $340 million in IRS tax revenue in the year 2021 alone, directly attributed to the increasing number of residents seeking opportunities elsewhere.

New York's Exodus

In close pursuit of California, New York experienced a substantial drop in its annual tax base, losing just under $300 million.

Source: Thomas Habr/Unsplash

According to Pesavento, this migration trend has marked one of the most significant population shifts seen in decades, with a considerable number of individuals opting not to return to their former residences.

Preference for Red States

Pesavento emphasizes that a substantial portion of the migrating population is choosing to settle in states like Texas, North Carolina, and Florida.

Source: Ian Harber/Unsplash

The allure of lower taxes, more business-friendly policies, and alignment with personal values acts as the driving force behind this relocation trend.

Partial Recovery in Urban Centers

While New York and Los Angeles witnessed a modest “revitalization” as COVID-19 restrictions gradually eased, the resurgence remains far from the robust social and economic boom experienced before the pandemic.

Source: Toomas Tartes/Unsplash

Homeowners, instead, are still opting to depart for states and smaller cities that offer a more appealing and comfortable lifestyle.

California Buyers in Suburban Markets

A noteworthy phenomenon accompanying the exodus from California is the propensity of buyers to gravitate toward suburban housing markets.

Source: Craig Tidball/Unsplash

This allows them to maintain proximity to major urban centers like New York City while enjoying the increased space and outdoor amenities offered by suburban living.

International Investment in New York Real Estate

The growth of New York’s real estate sector in the post-pandemic era has been substantially fueled by international markets, particularly investors hailing from China and Russia.

Source: Paul Nylund/Unsplash

Their investments have significantly contributed to the resurgence of this sector.

Supply Chain Issues and Inflation Impacting Housing

The housing market has been affected by supply chain disruptions and rising inflation, leading to increased construction costs.

Source: Tierra Mallorca/Unsplash

Consequently, this has constrained the availability of new properties for prospective buyers.

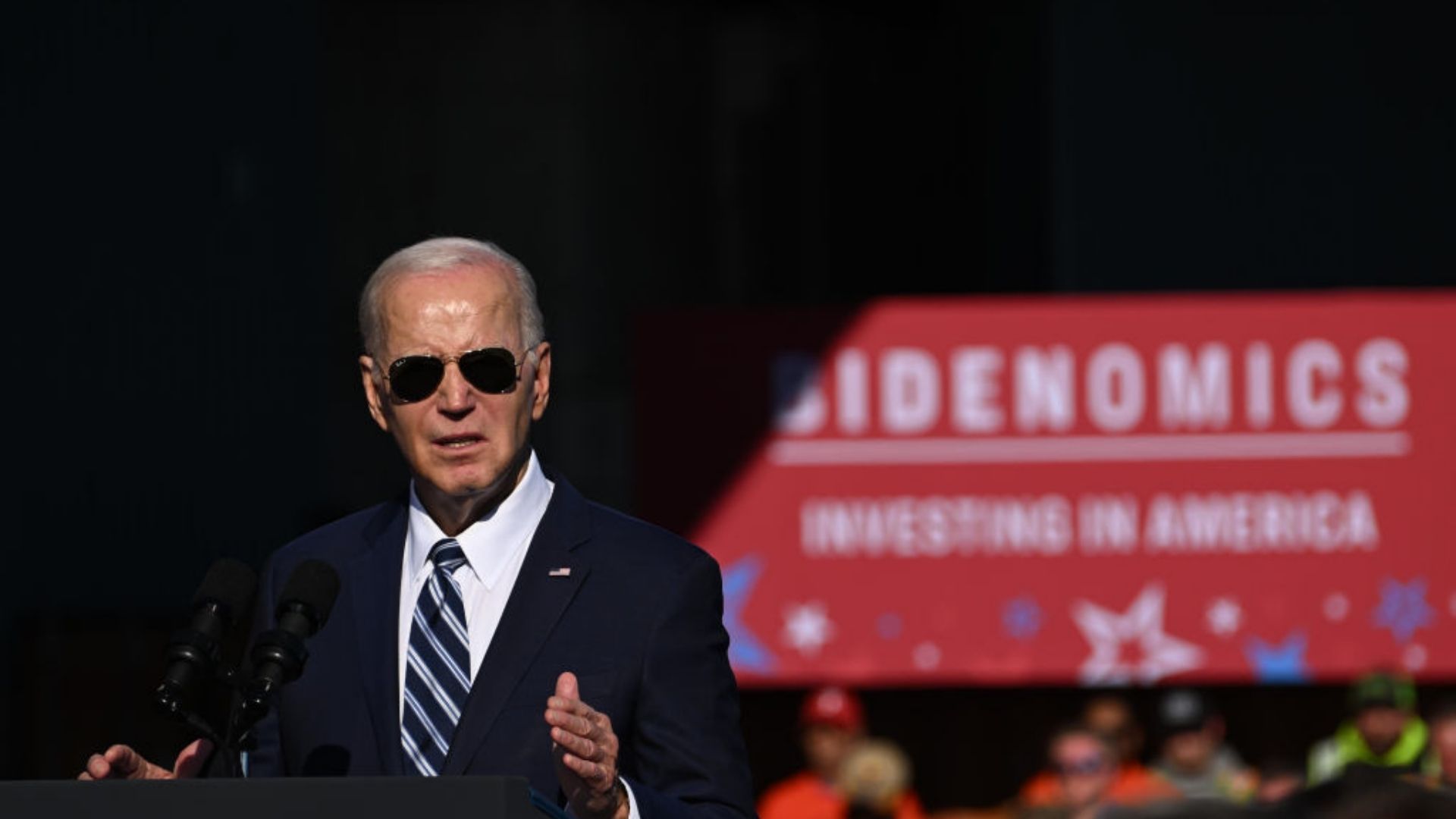

Biden Administration's Economic Efforts

In an attempt to counteract rising costs, the Biden administration has introduced various strategies.

Source: Getty Images

Nevertheless, there is a disparity in expert opinions regarding their efficacy, with some experts perceiving the Inflation Reduction Act as having limited impact.

Individual Financial Responsibility

Experts like Michael Lush suggest that individuals should actively take charge of their financial situations rather than solely relying on government interventions.

Source: Getty Images

This proactive approach includes building substantial emergency reserves and exploring alternative investment opportunities that better align with one’s financial goals.