Amidst Rising Inflation, UAW Calls For Cost-of-Living Salary Adjustments

American workers are finding it increasingly difficult to make ends meet as their paychecks struggle to keep pace with rising costs.

Inflation Has Increased Prices Significantly

While annual pay increases have managed to outpace inflation since May, the purchasing power of these wages has steadily eroded over the past two years due to inflation, which has driven overall prices up by roughly 12%.

Essential expenses like groceries and utilities have experienced even steeper hikes.

Source: Mario Tama/Getty Images

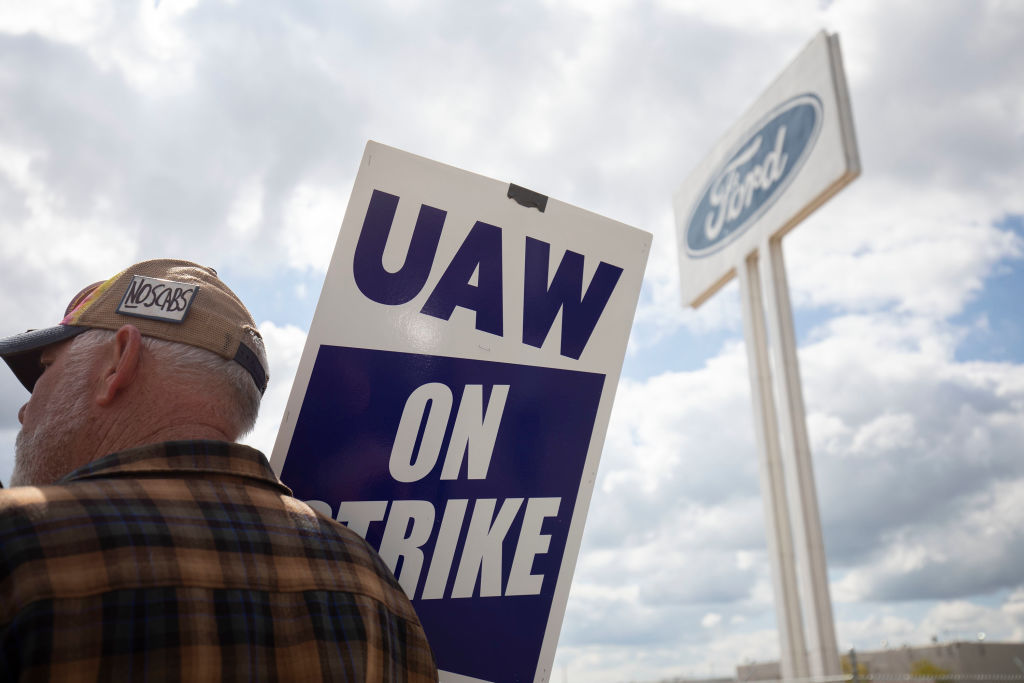

Keeping Up With The Cost Of Living

Faced with the harsh reality of inflation eroding the budgets of millions of households, labor unions like the United Auto Workers are now advocating for the revival of a once-common but now seldom-seen mechanism that ensures wages keep up with the rising cost of living.

Source: Sarah Rice/Getty Images

The COLA Mechanism

This mechanism, known as COLA or cost-of-living adjustments to paychecks, is familiar to Social Security recipients who rely on these adjustments to their fixed incomes to keep pace with inflation.

Source: Kevin Dietsch/Getty Images

Previous Increases Have Ceased

However, for the rest of the workforce, the practice of embedding regular pay increases into union contracts has faded away over the past half-century, and even the government has ceased to track data related to such adjustments.

Source: Bill Pugliano/Getty Images

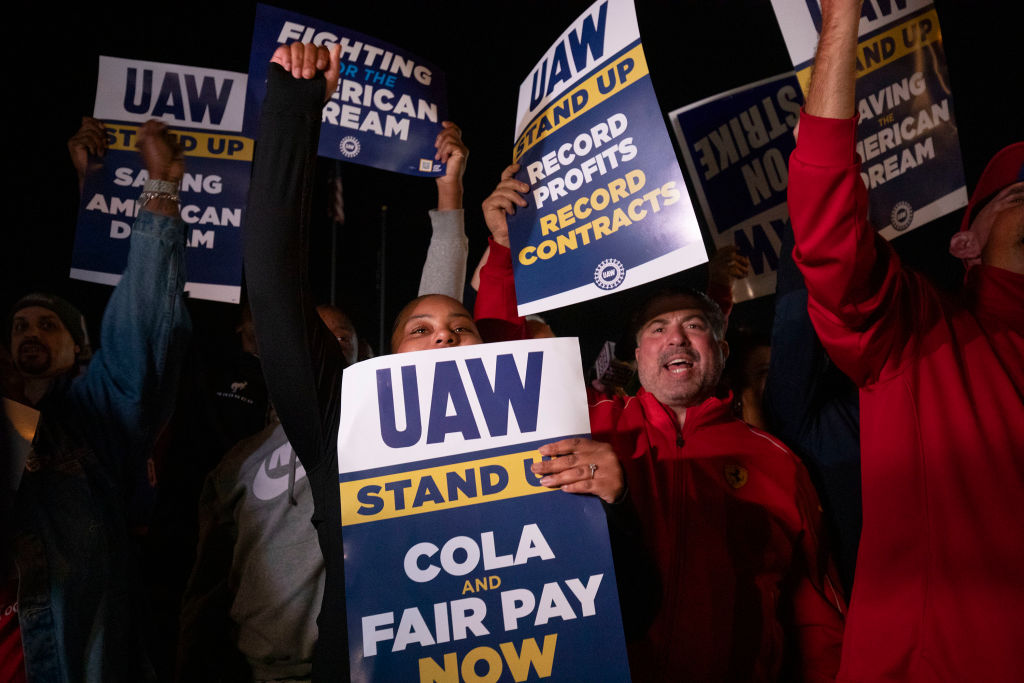

Intense Negotiations

However, the concept of COLA is making a comeback in the national discourse.

In the midst of intense negotiations with automakers, the United Auto Workers (UAW) has made it clear that they will not agree to a contract without the inclusion of a COLA provision, as reported by an anonymous source familiar with the contract discussions and cited by the Detroit Free Press, a part of the USA TODAY network.

Source: Bill Pugliano/Getty Images

Responses To High Inflation

Rebecca Kolins Givan, an associate professor at the Rutgers School of Management and Labor Relations in New Jersey, commented on this resurgence, stating, “(We’ve seen) very high inflation. Workers are feeling that pain and they’re saying, ‘We want to be protected.'”

Source: Bill Pugliano/Getty Images

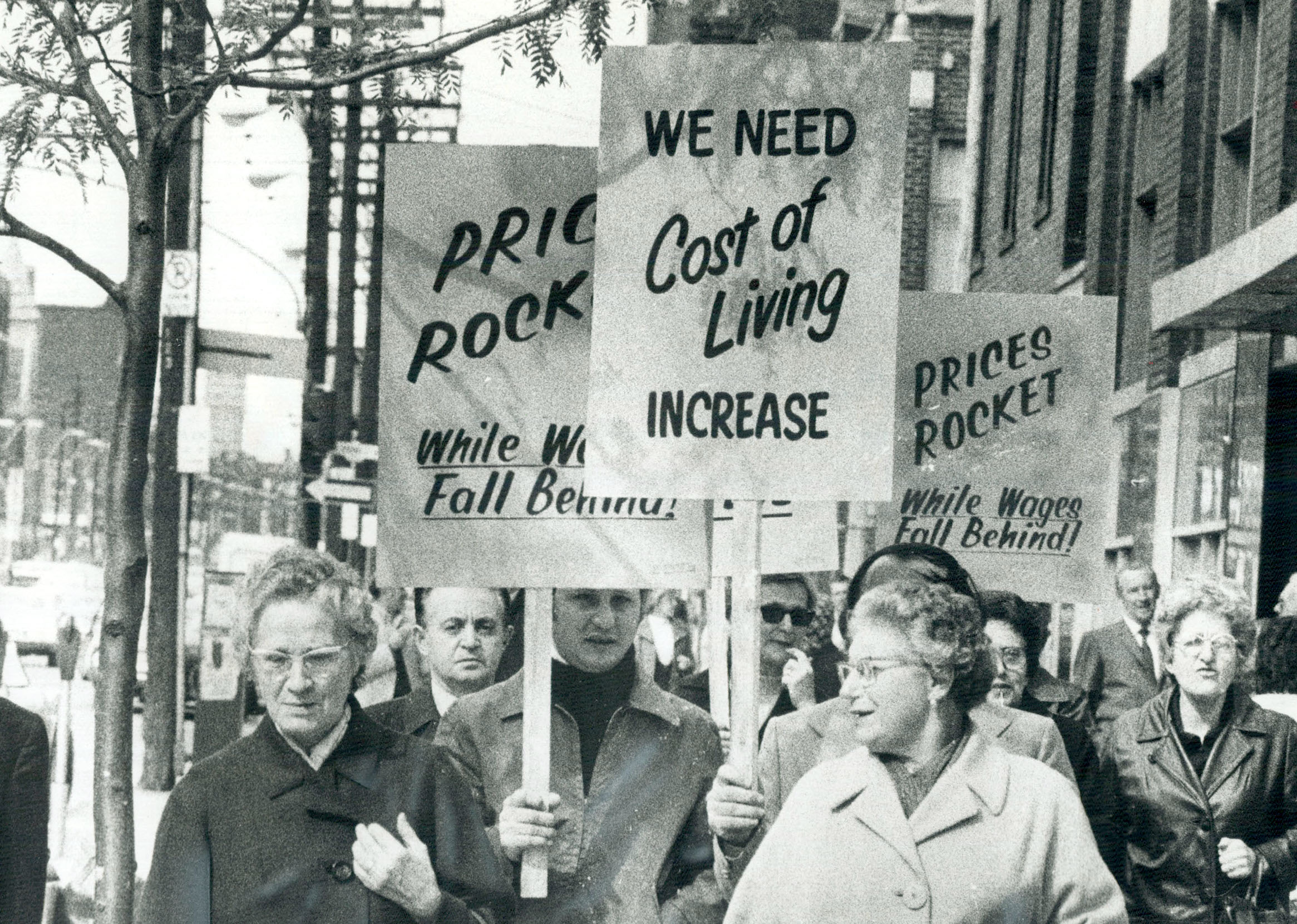

Once A Common Labor Union Contract Feature

It’s worth noting that COLA provisions were once a common feature in labor union contracts, with as many as 61% of them incorporating such adjustments in 1976, according to data from the Bureau of Labor Statistics (BLS).

However, two decades later, this percentage had dwindled to roughly one-third of its peak.

Source: Scott Olson/Getty Images

UAW And The Detroit Three

Among the contracts featuring COLA provisions were those between the UAW and the Detroit Three automakers (General Motors, Ford, and Stellantis, formerly known as Chrysler).

These wage adjustments were introduced in 1948 and 1950 in response to a surge in inflation, with consumer prices increasing by nearly 20% from the previous year in March 1947.

Source: Bill Pugliano/Getty Images

Consumer Prices Soared

A similar inflationary spike preceded the peak of COLA usage in the mid-1970s, with overall consumer prices soaring by 11.8% year-over-year in January 1975.

“The prominence of unions in the 1970s and ’80s also helped COLA numbers,” according to data from the BLS.

It’s revealed that in 1983, the first year for which comparable data is available, 20% of American workers were union members, in contrast to just 10% in 2022.

Source: Bettmann/ Contributor

Unions Were Stronger

Rebecca Kolins Givan, an expert in labor relations, emphasized, “When unions were stronger, they were able to fight for COLAs and win them.”

However, as union influence waned and inflation subsided, COLA coverage followed suit. By 1995, only 22% of union contracts included these provisions, as per BLS records.

Source: Bob Riha, Jr./Getty Images

Detroit Three

Significantly, the COLA benefit was suspended in UAW contracts with the Detroit Three in 2009, a consequence of the financial crisis they faced in 2008.

Despite the subsequent recovery of these companies’ finances, the COLA clauses have not been reinstated.

The most recent ratified contracts from 2019 reveal that COLA language was removed from agreements with Ford and Chrysler, while it remains suspended in the GM contract.

Source: Spencer Platt/Getty Images

No Indications

Presently, it remains uncertain how many union contracts currently incorporate COLAs, as the BLS ceased data collection on this matter after 1995 due to funding constraints, according to the agency.

Experts in the field do not have any indications that cost-of-living adjustments have experienced a significant resurgence since that time.

As Harry Katz, a professor specializing in collective bargaining at Cornell University, pointed out, “I don’t have any evidence that it was rebounding before the pandemic.”

Source: Scott Olson/Getty Images

The History Behind COLA Provisions

COLA clauses were originally designed to offer a solution for both workers and employers grappling with the uncertainty of multi-year contracts.

Rather than requiring both parties to predict future inflation rates during wage negotiations, COLA provisions provided a mechanism to account for unexpected increases in consumer prices.

Although data on the prevalence of cost-of-living adjustments in contemporary settings are scarce, Katz pointed out that they may not be practical for non-union jobs that lack multi-year contracts.

Katz stated, “I don’t know of an instance where a non-union workforce has a COLA. You’re setting pay annually and you don’t have uncertainty with inflation. You don’t need a mechanism for that.”

Source: Goode Jeff/ Toronto Star via Getty Images

Incomes Are Not Keeping Up With Price Surge

In non-union jobs, pay increases are typically not guaranteed and vary by industry, company, location, and individual job performance.

A survey by the compensation research and software firm Payscale conducted in late 2022 found that 80% of organizations planned to provide base pay increases that year, with 56% intending to offer raises exceeding 3%.

However, despite recent data indicating that average U.S. wage growth has finally surpassed the rate of inflation since May, many Americans still feel that their incomes have not caught up with the significant surge in prices.

Source: Bill Pugliano/Getty Images